Sinequa For Private Equity

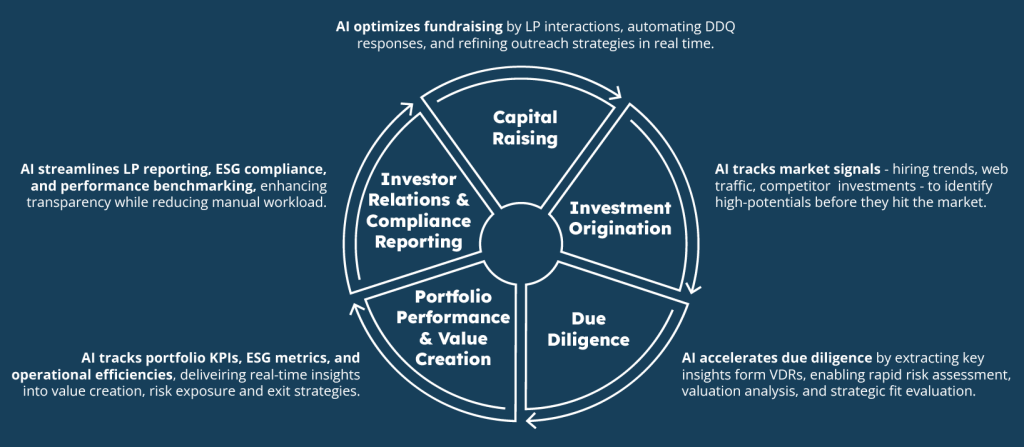

AI is a strategic game-changer for the entire Private Equity ecosystem.

It’s fundamentally transforming how data is captured, analyzed, interpreted, and applied across the investment lifecycle.

More than just a tool, AI is becoming the core infrastructure of modern Private Equity. Adopting it is no longer a tech decision—it’s a long-term competitiveness imperative.

ChapsVision offers purpose-built AI solutions to help Private Equity players boost productivity and safeguard the value of their investments.

AI Experts in Private Equity

- Contextual Document Analysis: Instantly analyze and summarize large volumes of text from diverse documents to identify key contract clauses, financial risks, and potential inconsistencies.

- Conversational Access to Information: Ask questions or make requests in natural language—AI agents understand and respond just as naturally.

- Reliable AI-Driven Recommendations: Leverage the full power of generative AI to run analyses, provide recommendations, and even suggest further research paths.

- Comprehensive Insights: A complete, detailed view—AI agents review all strategic content (file shares, CRMs, financial databases, internal documents, regulatory filings, market intelligence, etc.) and centralize it in one place for full visibility.

- Faster Decisions, Even Faster Documents: AI agents speed up the review process, delivering instant recommendations aligned with your goals and KPIs, while automating the creation of standard reports.

AI and NLP tailored for Private Equity

- Threads: Get answers across all your documents, synthesize information, and receive in-depth analysis, simply by making a natural-language request.

- Smart Checklists: Automate content reviews with reusable checklists that adapt to your fund and investment strategies.

- Dynamic Dashboards: Track and visualize KPIs automatically extracted directly from your content.

- Canvas: Skip the tedium of writing analyses and reports – let an AI Agent do it for you! Create analyses, summaries, or even construct formal documents from a library of templates and instructions (prompts).

Key Advantages of Sinequa For PE

Security: Encryption ensures the protection of confidential, transaction-related data.

Collaboration: Centralized knowledge sharing accelerates decision-making.

Speed: Cuts down time spent on data retrieval, analysis, and content creation.

Adaptability: Easily scales across organizations of any size and integrates with existing technologies.

Full Visibility: Make decisions based on complete access to all your information.

Accuracy: Cited sources ensure data reliability, while advanced RAG technology minimizes hallucinations.

Future-Proof: Choose any LLM—and switch when needed to stay ahead of the AI curve.

Flexibility: Agents can use any application’s API and collaborate with each other.

Ease of Use: Build your own agents with a no-code orchestration interface.

Sinequa is more than a platform — it’s your AI copilot for Private Equity.

Combined with ChapsVision’s OSINT, cybersecurity, and crisis management solutions, it forms a comprehensive infrastructure to secure your investments.

OSINT-Powered Due Diligence

Uncover hidden risks, safeguard your decisions

With ChapsVision’s OSINT, you can identify early on:

Assess management teams

Identify reputational factors, operational realities, and potential risks

Uncover key insights

Detect hidden trends

Why it matters

Financial impact: Analysis errors = significant losses

Strategic vulnerability: Your targets often come with high-risk profiles

Compliance & reputation: Avoid sanctions and protect your brand image

We combine expert analysts, proprietary technologies, and exclusive data to ensure enhanced vigilance throughout the entire investment cycle.

Cybersecurity for Private Equity

Secure your operations, data, and valuations

Funds and portfolio companies are prime targets. ChapsCyber supports you with a comprehensive cybersecurity offering, purpose-built for the Private Equity world.

What we protect

• Sensitive transaction and investor data

• Portfolio companies’ IT systems

• Fund valuation integrity and reputation

Our services include

- Audits, penetration testing, Red Team operations

- Business Continuity & Disaster Recovery plans (BCP & DRP)

- Incident response and data breach management

- Regulatory compliance (DORA, NIS2, GDPR, LPM)

Why partner with us ?

• Deep Private Equity and cybersecurity expertise

• Strong understanding of IT infrastructure and operational workflows

• Packaged, cost-effective intervention frameworks

Crisis Management & Resilience

Prepare, Respond, Reassure — Across Every Layer of Private Equity

A poorly managed crisis can jeopardize fundraising, destabilize a portfolio, or delay an exit.

Crisotech helps you anticipate, structure, and manage high-pressure scenarios with confidence.

What we deliver

• Realistic crisis simulation exercises, including media stress

• End-to-end crisis response planning for both funds and portcos

• Dedicated tools: Iremos Crisis, CAIAC real-time mapping platform

• Training in crisis communication and high-stakes decision-making

Strategic Impact

• Reduced operational and regulatory risk

• Improved portfolio company valuation at exit

• Stronger LP confidence in your governance

Contact us

Contact us to discuss about your project