Insurance & Mutual Health Insurance

Build a solid future business with ChapsVision

AN INDUSTRY REINVENTING ITS FUTURE!

NEW CHALLENGES ARE EMERGING...

Against a backdrop of concentration, fierce competition coupled with continious pressure, and the digitalization of customer relationships, insurers and mutual insurers are confronted by numerous challenges. Among the most important are included : the understanding of the risks they are going to underwrite, adapting pricing according to customer segmentations, developing new offers, acquiring new customers, retaining existing customers, and many more.

DATA IS QUIETLY REVOLUTIONISING BUSINESS PRACTICES ...

With the introduction of “Pay How You Drive” offers and data-self-service practices, the growing amount of online data will not only enable insurers to collect and process it to enhance the knowledge of their customers/members and their risk profiles, but also to offer new, better-targeted products to attract new prospects.

While managing and capitalizing on internal data is a key strategy for insurers and mutual insurers, monitoring the business ecosystem is just as important, to remain competitive while continuing to attract and retain customers.

Learn how ChapsVision, a specialist in sovereign data processing, enables you to overcome your challenges through a comprehensive software suite based on its own system for processing massive, heterogeneous data.

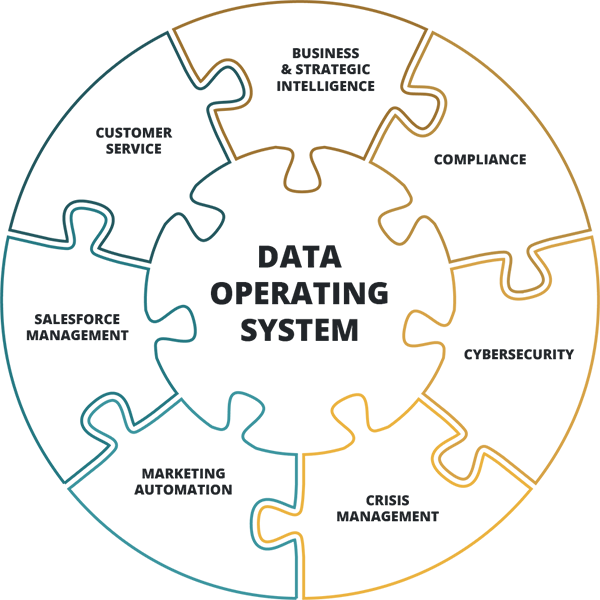

CHAPSVISION OFFERS YOU A 360° SOlution

- Acquire Extended Customer Knowledge (RCU)

- Predict economic change with sophisticated modeling scenarios

- Automatically generate leads to improve business performance while reducing prospecting effort

- Identify additional or cross-sell opportunities

- Gather, analyze, and disseminate web information extensively

- Understanding ecosystems and their changes

- Monitor news in real time

- Detect opportunities and threats early

- Comply with KYC Process

- Collect customer risk profile, experience, objectives in accordance with MIFID II

- Comply with GDPR

- Combat money laundering and the financing of terrorism (AML/CFT)

- Analyzing and transcribing telephone agent conversations

- Oversees telemarketing in accordance with the Naegelen law

- Ensuring the security of goods and people through video stream analysis combined with AI

- Secure communication between 2 information systems through a two-way communication gateway

- Perform & audits and intrusion testing

- Ensure compliance and certification of sensitive systems

- Establish resiliency procedures

- Attend training & crisis exercises

- Be warm

- Use digital tools to help with crisis management

- Get built-in feedback

- Define your best targets with all the customer knowledge

- Orchestrate & automate your multi-channel campaigns with highly personalized messages tailored to your customers' lifecycle (acquisition, development, loyalty, ...)

- Measure the performance of your campaigns

- Manage Accounts and Contacts

- Structure and trace business processes (prospection, appointment, reporting, offering, contracting)

- Measure Business Performance

- Manage Omnichannel Inbound Contacts and Interactions

- Scan phone conversations and documents

- Process requests and complaints based on task workflows

- Measuring the effectiveness and satisfaction of policyholders/members

THE BENEFITS OF OUR COMPREHENSIVE PACKAGES!

MASTER YOUR COMPLIANCE AND YOUR MARKET KNOWLEDGE

SEMANTIC ANALYSIS &

DATA VISUALIZATION

qwam by chapsvision

Digital fingerprint generation

owlint by chapsvision

BROADEN YOUR KNOWLEDGE & STRENGTHEN YOUR CUSTOMER RELATIONSHIPS

The increasing complexity of insureds’/members’ needs, their ever changing expectations and the imperative of personalizing offers while meeting their requirements in terms of transparency and management of sensitive data are considerable challenges. Our approach is designed to provide you with the best solutions to optimize your operations and improve your understanding of your members and insureds, while navigating an ever-changing environment. Learn more about our natively connected, modular solutions, designed to enhance customer engagement and improve performance.

INCREASE YOUR SALES

Customer expectations are continually evolving, so insurance and mutual companies have to constantly re-evaluate their sales methods to stay relevant and competitive. Building customer loyalty and delivering a distinctive value proposition have become key factors in maintaining sustainable sales performance. Learn more about our comprehensive solution that enables you to effectively manage accounts and contacts, structure and monitor all sales processes, from prospecting to contracting, while measuring and improving your growth.

STRENGTHEN YOUR SECURITY AND ENHANCE YOUR RESILIENCE

Insurers and mutual insurers are under growing threat from sophisticated cyber threats, requiring reinforced IT security to shield sensitive policyholder data. In addition, the growing volatility of natural and economic risks calls for innovative risk management strategies to ensure their sustainability. Learn how ChapsVision can support you in these areas by strengthening the security of your employees, business practices, infrastructures and information systems, while benefiting from our crisis management services.